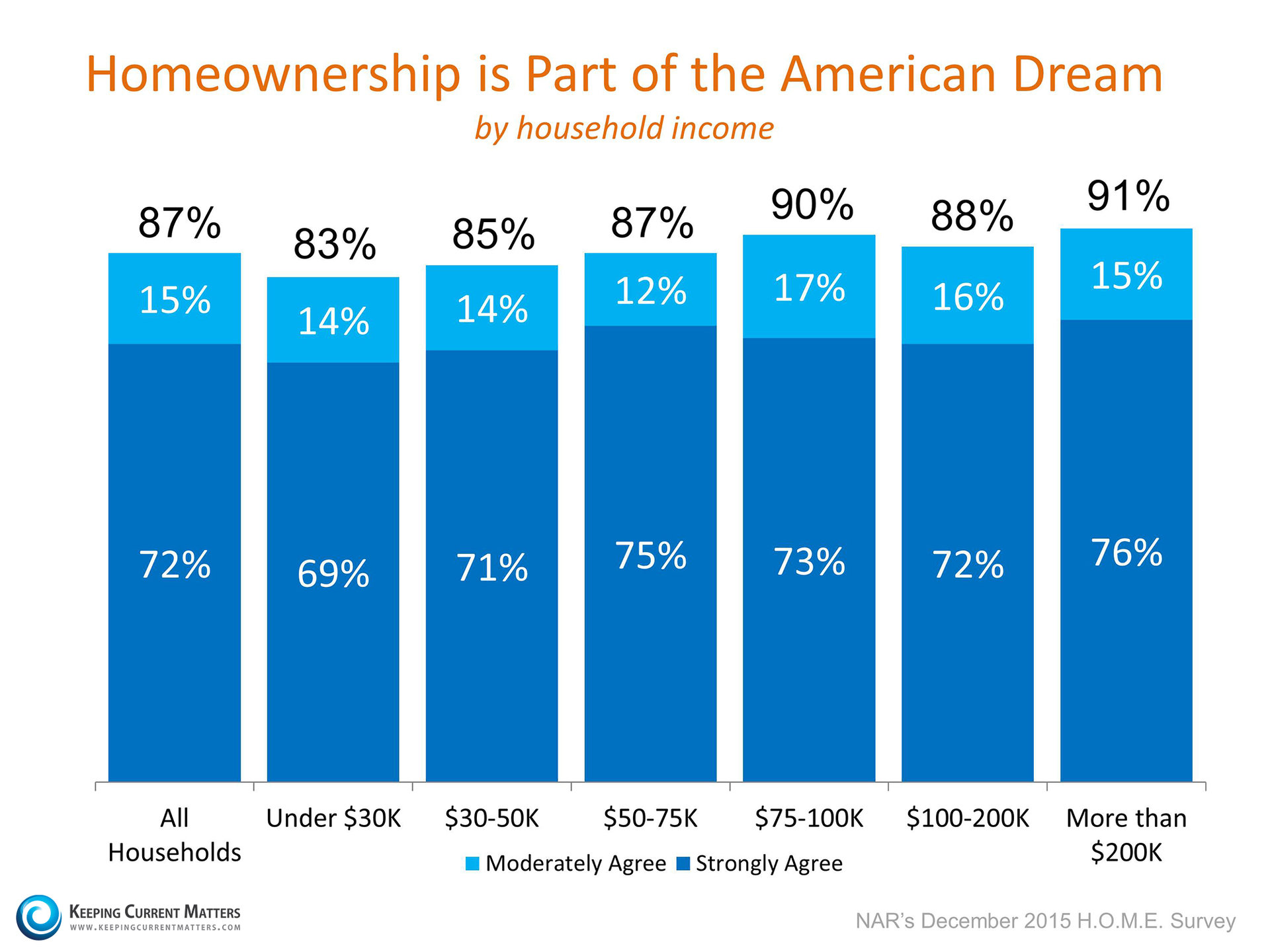

The National Association of Realtors (NAR) just released the first edition of their Housing Opportunities and Market Experience Survey (H.O.M.E.). NAR explained that the report covers:

“…core topics that will be tracked on a monthly basis such as views on housing as a good financial investment, whether homeownership is part of the American Dream…”

The current survey confirmed two long standing beliefs regarding homeownership:

1. Americans at every income level believe homeownership is part of the American Dream

2.) Americans at every age believe that homeownership is a good financial decision

Bottom Line

Americans in all age groups and income levels believe in homeownership as a piece of their American Dream. If you are ready and willing to buy your dream home, meet with a local real estate professional who can help you determine if you are able to.