Whether you are a first time or a move-up buyer, there are two factors that will impact the amount of house you can afford in your price range: home prices & mortgage rates.

Let’s look at what the experts are predicting over the next twelve months for these two areas:

PRICES

Over 100 economists, real estate experts and investment & market strategists were recently polled as a part of the Home Price Expectation Survey. They were asked to project where home prices are headed. The average value appreciation projected over the next twelve-month period is approximately 4.4%.

MORTGAGE INTEREST RATES

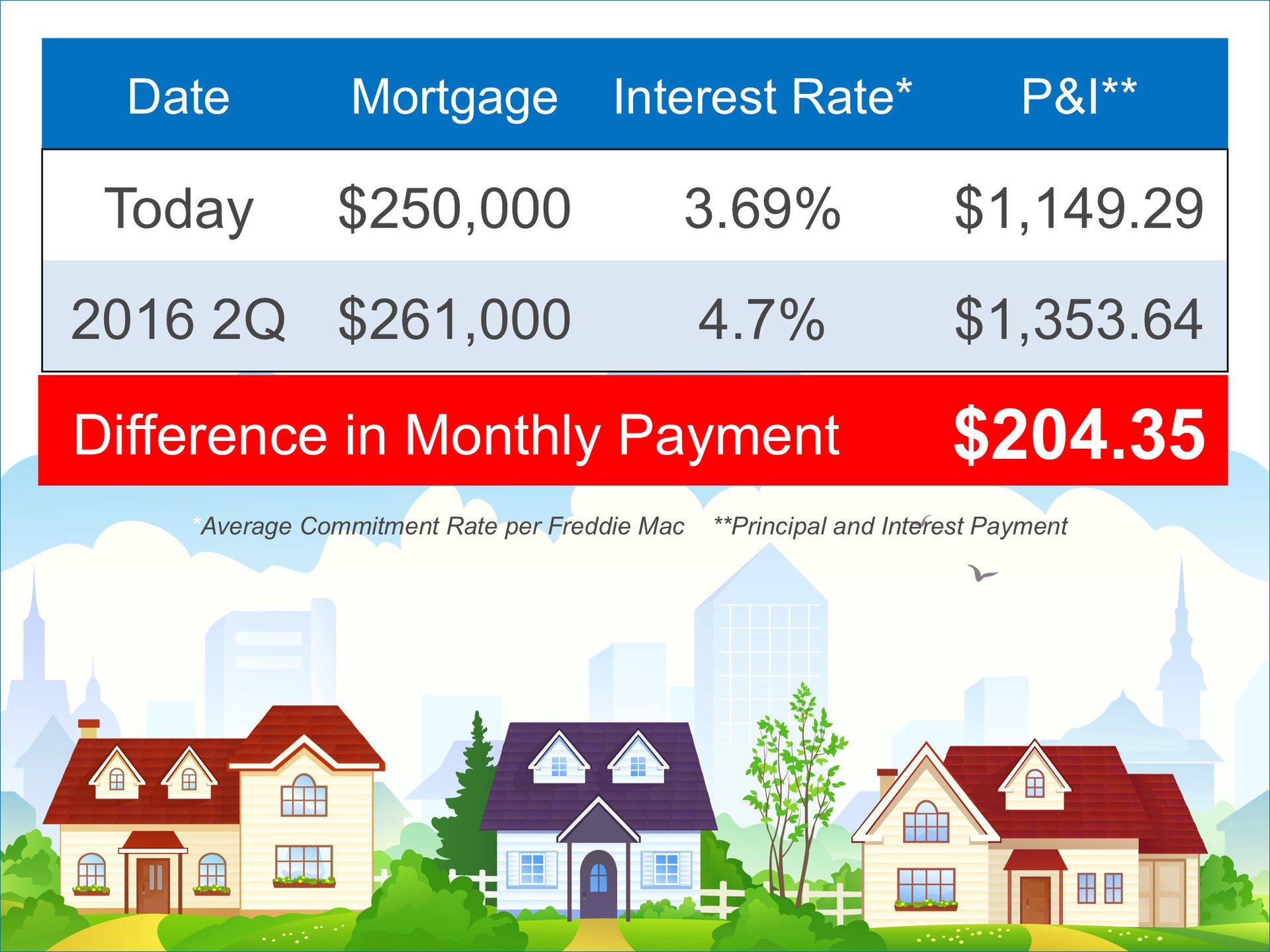

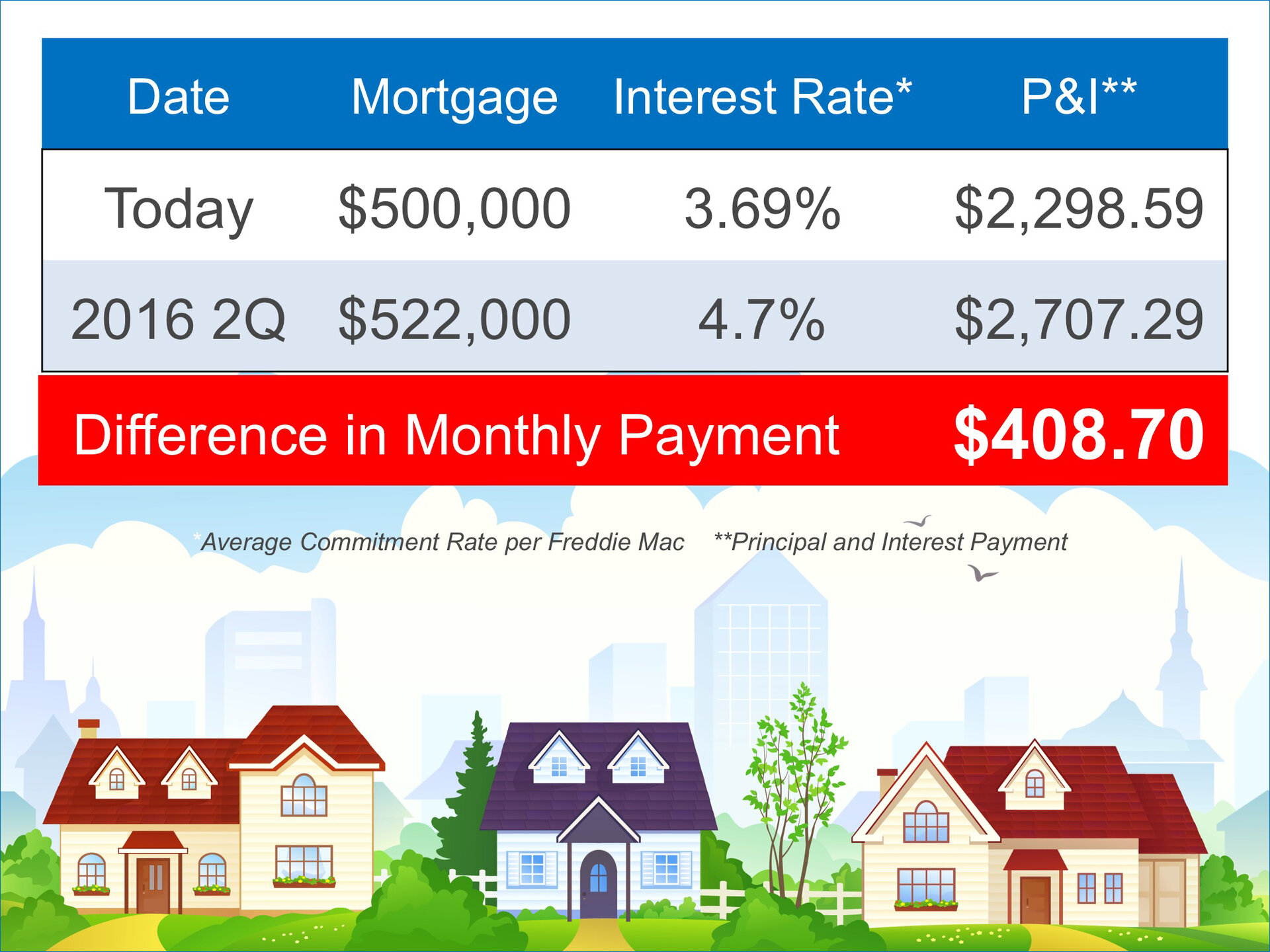

In the latest Economic & Housing Market Outlook from Freddie Mac, they predict that the 30-year fixed mortgage rate will be 4.7% by this time next year. As of last week, the Freddie Mac rate was 3.69%.

What does this mean to you?

If you are a first-time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait until next year to buy:

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait a year to buy:

Bottom Line

With both home prices & interest rates projected to increase, waiting to buy could put a serious dent in your family’s wealth.